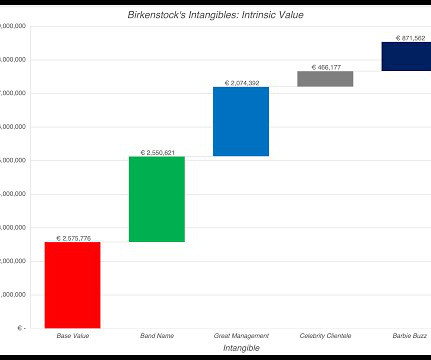

Invisible, yet Invaluable: Valuing Intangibles in the Birkenstock IPO!

Musings on Markets

OCTOBER 6, 2023

The resulting debate among accountants about how to bring intangibles on to the books has spilled over into valuation practice, and many appraisers and analysts are wrongly, in my view, letting the accounting debate affect how they value companies.

Let's personalize your content