Risk = Danger + Opportunity!

CFO News Room

JANUARY 20, 2023

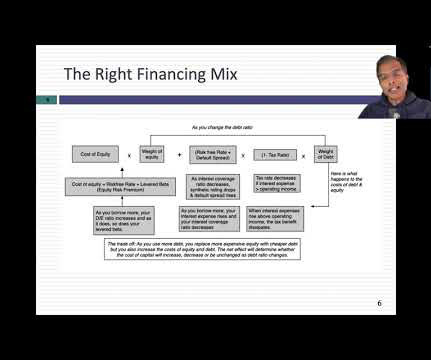

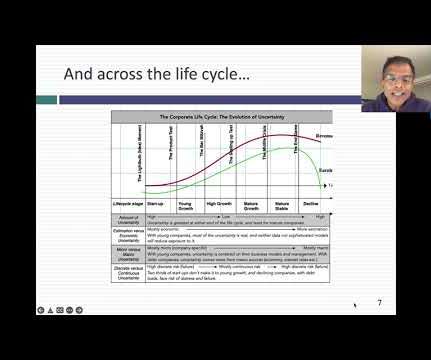

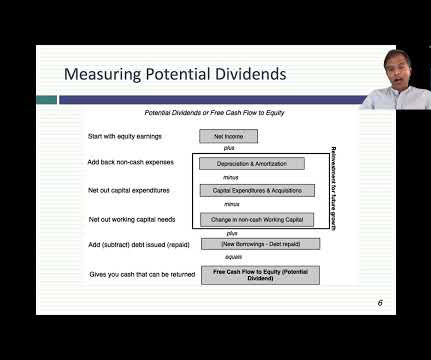

Risk and Hurdle Rates In investing and corporate finance, we have no choice but to come up with measures of risk, flawed though they might be, that can be converted into numbers that drive decisions. Not surprisingly, both these forces play a role in how companies and investors set hurdle rates.

Let's personalize your content