Data Update 6 for 2025: From Macro to Micro - The Hurdle Rate Question!

Musings on Markets

FEBRUARY 8, 2025

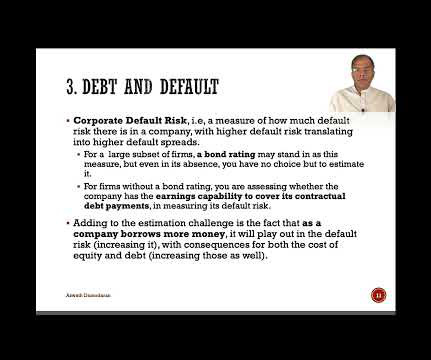

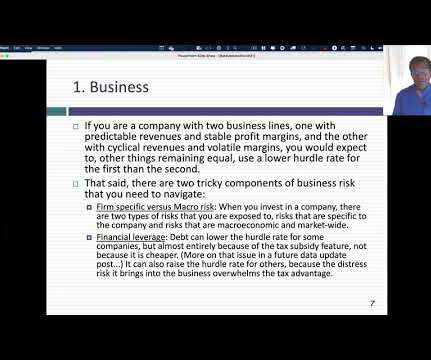

A key tool in both endeavors is a hurdle rate a rate of return that you determine as your required return for business and investment decisions. It deepens the acquaintance because you encounter hurdle rates in almost every aspect of finance, and it ruins it, by making these hurdle rates all about equations and models.

Let's personalize your content