Risk = Danger + Opportunity!

CFO News Room

JANUARY 20, 2023

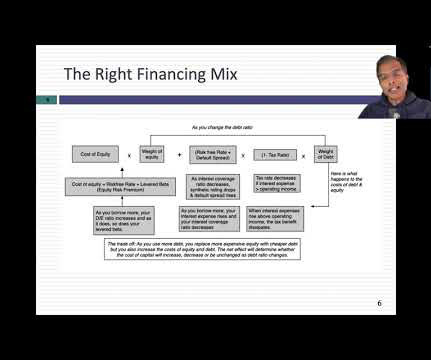

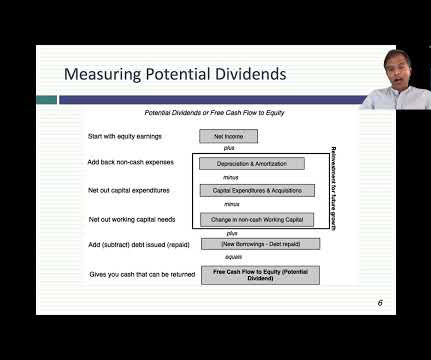

Risk and Hurdle Rates In investing and corporate finance, we have no choice but to come up with measures of risk, flawed though they might be, that can be converted into numbers that drive decisions. In corporate finance, this takes the form of a hurdle rate , a minimum acceptable return on an investment, for it to be funded.

Let's personalize your content