Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

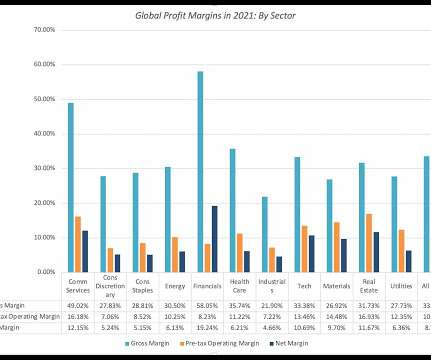

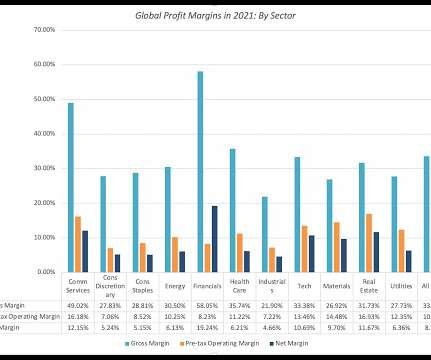

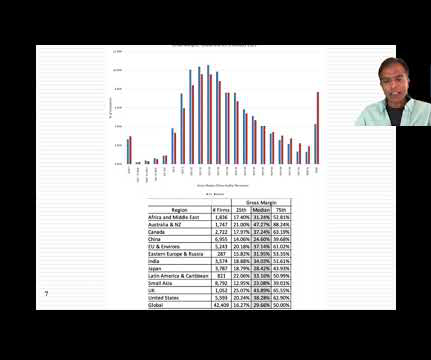

The last few years have been eventful for all companies, with the COVID crisis and ensuing economic shut down causing pain for companies, with recovery coming in 2021, as the global economy opened up again. Costs grow at a slower rate than revenues. Superior unit economics. Economies of scale. High gross margins.

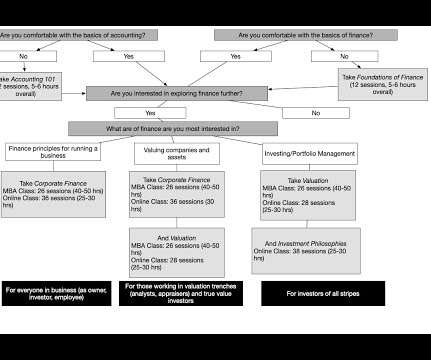

Let's personalize your content