Data Update 7 for 2025: The End Game in Business!

Musings on Markets

FEBRUARY 12, 2025

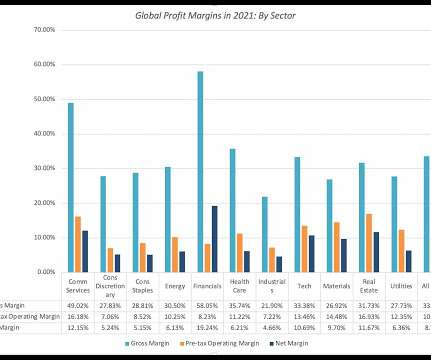

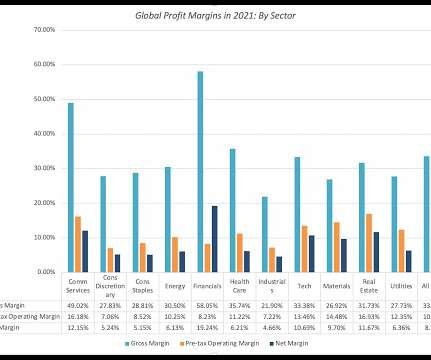

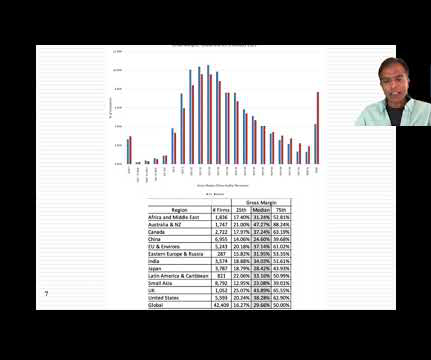

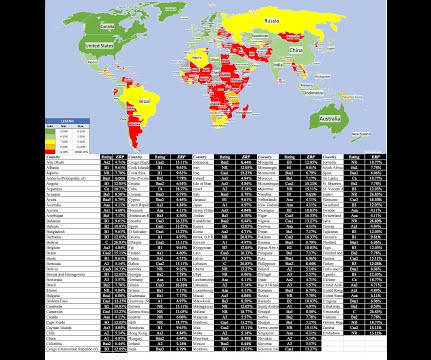

In this post, I will focus on how companies around the world, and in different sectors, performed on their end game of delivering profits, by first focusing on profitability differences across businesses, then converting profitability into returns, and comparing these returns to the hurdle rates that I talked about in my last data update post.

Let's personalize your content