Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

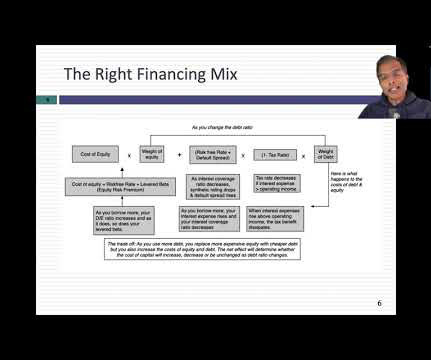

Income from financial holdings (including cash balances, investments in financial securities and minority holdings in other businesses) are added back, and interest expenses on debt are subtracted out to get to taxable income. Costs grow at a slower rate than revenues. Superior unit economics. Economies of scale.

Let's personalize your content