Musings on Markets: A Return to Teaching: The Spring 2023 Edition

CFO News Room

DECEMBER 22, 2022

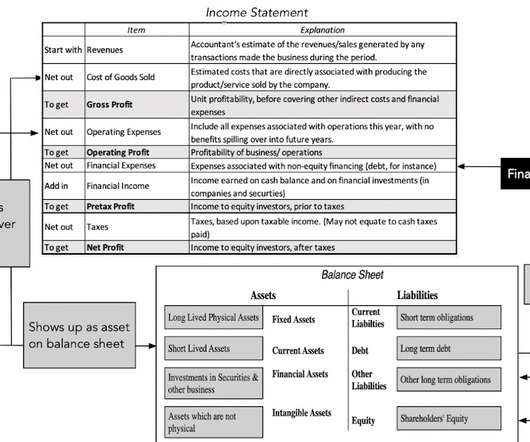

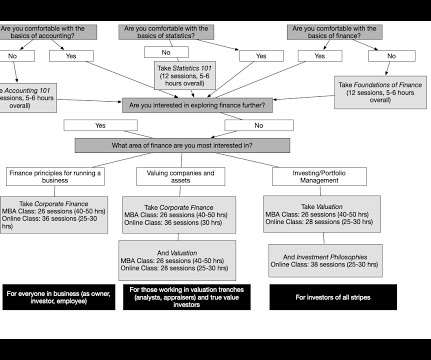

Starting in late January 2023, I will be back in the classroom, teaching valuation and corporate finance to the MBAs and valuation to the undergraduates, and these classes will continue through May 2023.

Let's personalize your content