Data Update 5 for 2024: Profitability - The End Game for Business?

Musings on Markets

JANUARY 31, 2024

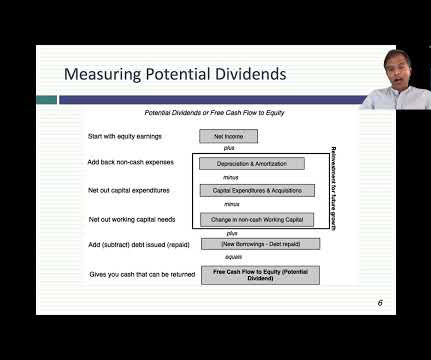

In my last three posts, I looked at the macro (equity risk premiums, default spreads, risk free rates) and micro (company risk measures) that feed into the expected returns we demand on investments, and argued that these expected returns become hurdle rates for businesses, in the form of costs of equity and capital.

Let's personalize your content