10 Types of Financial Models

The Finance Weekly

OCTOBER 29, 2024

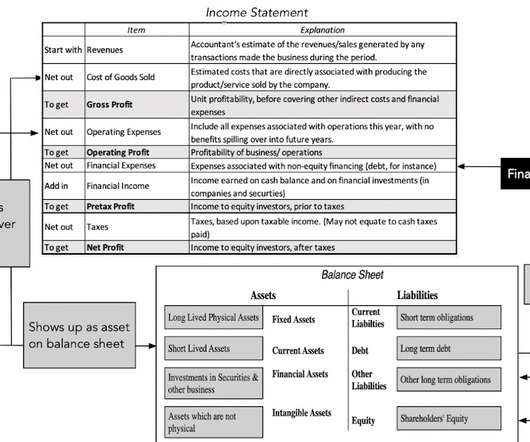

Financial models are essential for organizations, helping forecast financial performance using historical data and future projections. Financial modeling involves creating a mathematical representation of a company's financial situation, typically using tools like Excel.

Let's personalize your content