Data Update 6 for 2023: A Wake up call for the Indebted?

Musings on Markets

FEBRUARY 27, 2023

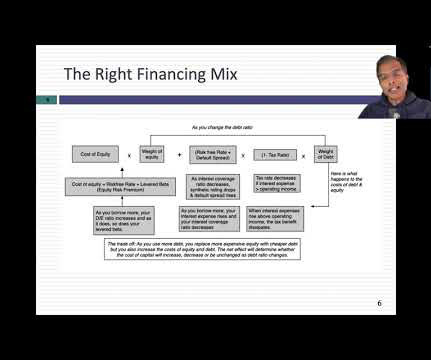

In fact, that may explain why firms that trade at low EV to EBITDA multiples are more likely to become targets in leveraged buyouts (LBOs) or leveraged recapitalizations. Business risk : Not surprisingly, for any given level of cash flows and marginal tax rate, riskier firms will be capable of carrying less debt than safer firms.

Let's personalize your content