Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

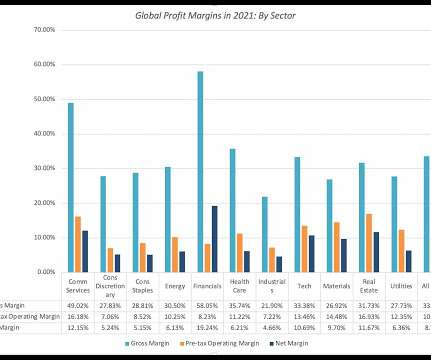

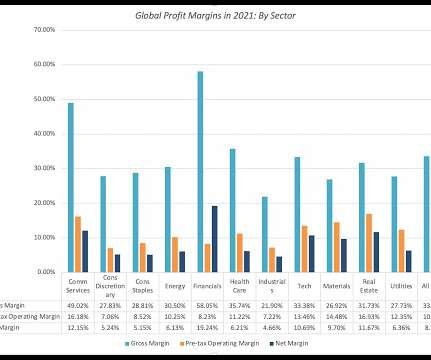

Even though we live in an age where user platforms and hyper revenue growth can drive company valuations, that adage remains true. The largest sector, in the US, in terms of market capitalization, is information technology and I have argued that tech companies age in “dog years” , with compressed life cycles.

Let's personalize your content