India plans stricter rules for companies with foreign ownership, sources say

CFO News

MAY 19, 2025

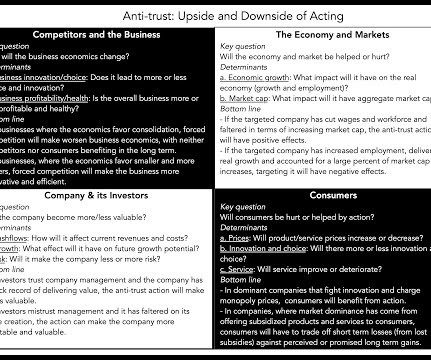

New rules may affect e-commerce and pharmaceutical companies. Share transfers and restructurings could face stricter FDI rules. India intends to revise foreign investment regulations. The goal is to monitor foreign-owned entities more closely. The government plans a new category for foreign-owned and controlled entities.

Let's personalize your content