Are You Prepared for Nonprofit Tax Deadlines?

The Charity CFO

SEPTEMBER 11, 2023

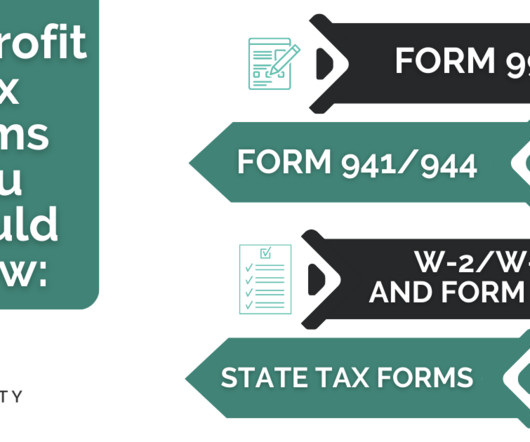

Taxes are rarely anyone’s idea of fun, but meeting nonprofit tax deadlines is critical to keeping even the most successful and impactful charities running. Unfortunately, they can often sneak up on busy nonprofit leaders, leading to a last-minute scramble to file – or worse. Read on as we break down the basics.

Let's personalize your content