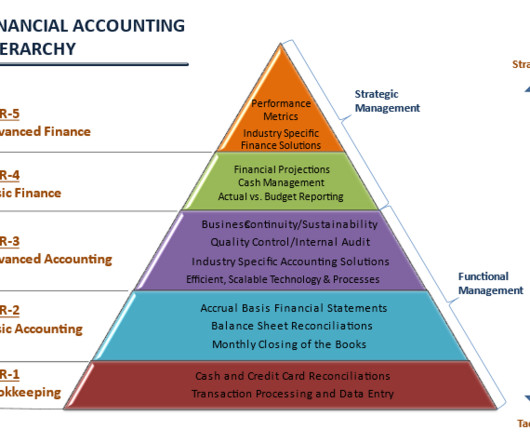

Financial Accounting Hierarchy - By JP Puchulu

Boston Startup CFO

APRIL 3, 2023

Familiarity with Generally Accepted Accounting Principles (GAAP) is essential. If you lack knowledge in accounting principles, you open yourself up to many potential risks, including inaccurate financial statements which can hinder your ability to make informed decisions.

Let's personalize your content