What is Financial Planning and Analysis (FP&A)?

Spreadym

JUNE 27, 2023

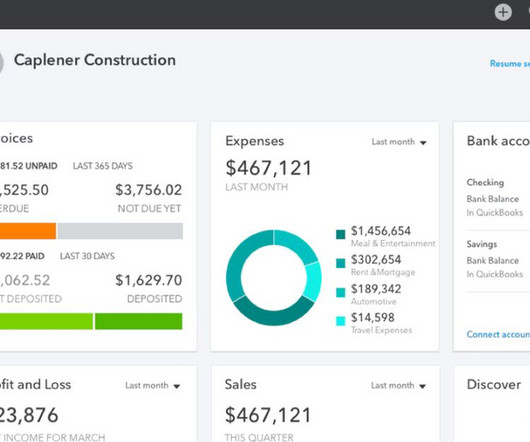

What is Financial Planning and Analysis or FP&A? FP&A is a process used by organizations to develop and manage their financial plans and make informed decisions based on financial analysis. What is Financial Planning and Analysis? Why Financial Planning and Analysis (FP&A) is important?

Let's personalize your content