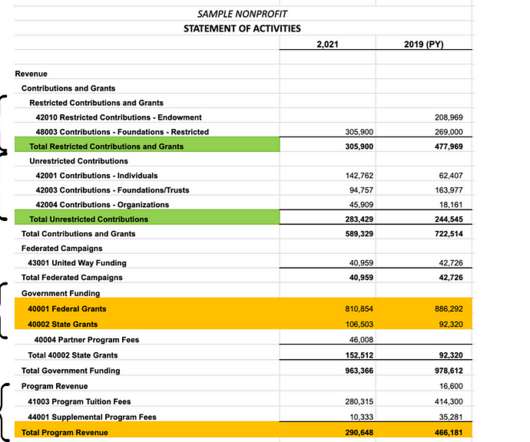

Statement of Activities: Reading a Nonprofit Income Statement

The Charity CFO

JANUARY 31, 2022

Like all nonprofit financial statements , the central role of the Statement of Activities is to provide transparency and accountability to your donors and board. If you use cash-based accounting, you’ll only record cash deposited into your bank during the reporting period. . Don't hire the wrong accountant for your nonprofit!

Let's personalize your content