Data Update 1 for 2024: The data speaks, but what does it say?

Musings on Markets

JANUARY 5, 2024

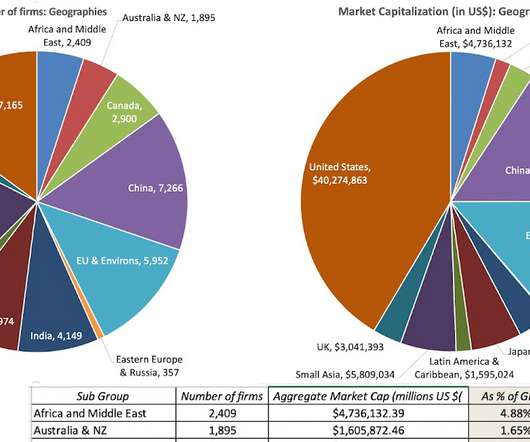

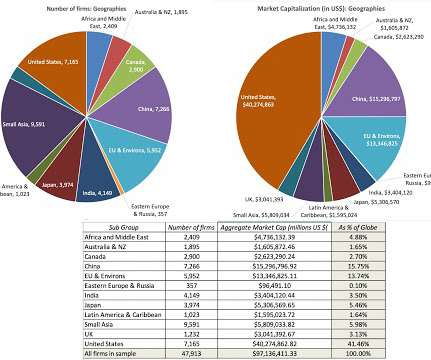

The Variables As I mentioned at the start of this post, this entire exercise of collecting and analyzing data is a selfish one, insofar as I compute the data variables that I find useful when doing corporate financial analysis, valuation, or investment analysis. will reflect the most recent quarterly accounting filing.

Let's personalize your content