Weekend Reading For Financial Planners (Dec 24-25) 2022

CFO News Room

DECEMBER 23, 2022

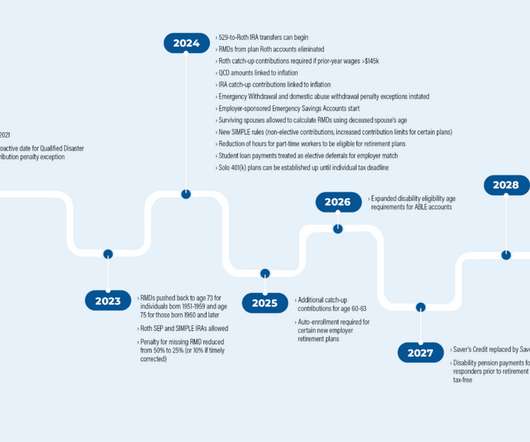

Enjoy the current installment of “Weekend Reading For Financial Planners” – this week’s edition kicks off with the news that Congress appears poised to pass “SECURE Act 2.0”, a series of measures that will have significant impacts on the world of retirement planning. And notably, while no single change in SECURE 2.0

Let's personalize your content