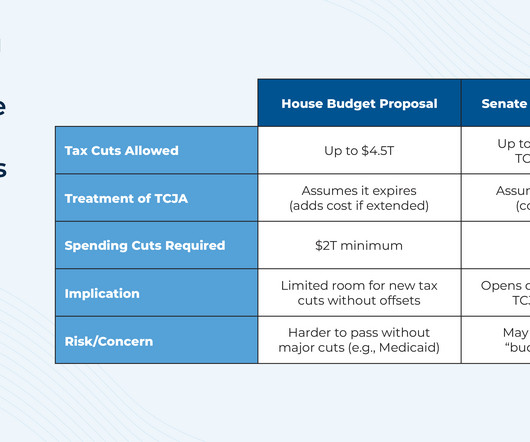

Analyzing Congressional Republicans’ Budget Proposal For The 2025 TCJA Extension

Nerd's Eye View

APRIL 30, 2025

Which has made it difficult for advisors and their clients to plan for the future with less than a year remaining before the scheduled sunset. Recently, however, the House and Senate agreed to adopt a budget resolution that represents a crucial first step in the process of passing a 'reconciliation' bill. Read More.

Let's personalize your content