AI's Winners, Losers and Wannabes: An NVIDIA Valuation, with the AI Boost!

Musings on Markets

JUNE 23, 2023

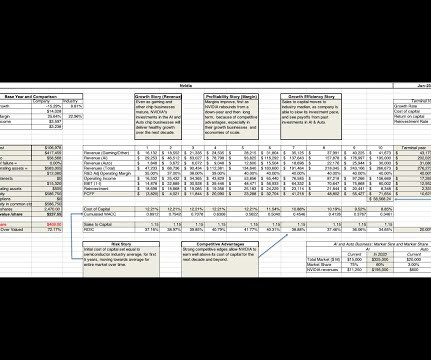

From 2001 to 2020, revenue growth at semiconductor businesses has dropped to single digits, as higher demand for chips in new uses has been offset by loss of pricing power, and declining chip prices. Sustained Profitability, with Cycles! While revenue growth has picked up again in the last three years, the business has matured.

Let's personalize your content