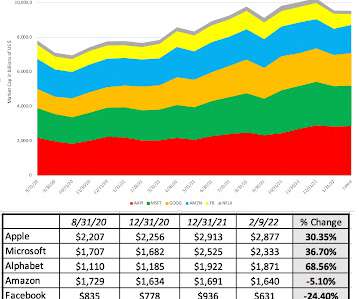

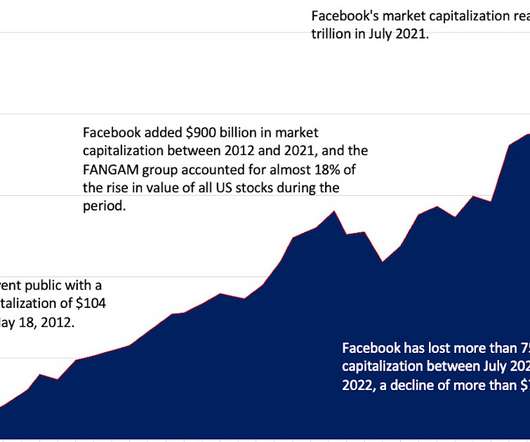

Facebook’s Shares Plunge After Profit Decline

CFO News Room

FEBRUARY 2, 2022

startled investors with a sharper-than-expected decline in profits and a gloomy outlook in its first earnings report since Chief Executive. Facebook also cited inflation as a weight on advertiser spending. and Canada, two of the company’s most profitable markets, the results show. Facebook parent. Meta Platforms Inc.

Let's personalize your content