The 5 best budgeting software solution to increase efficiency of the business

Spreadym

MAY 26, 2023

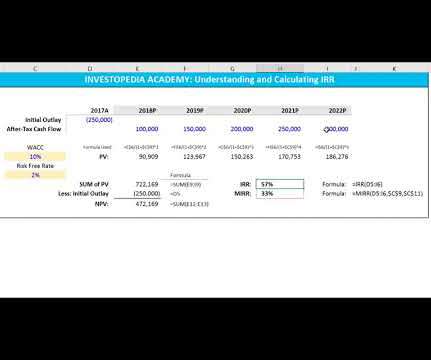

Budgeting software is an application designed to assist businesses in creating, managing, and tracking their budgets. It helps automate and streamline the budgeting process by providing tools and features to input financial data, allocate funds to different categories, monitor expenses, and generate reports.

Let's personalize your content