Q&A: Your Money Map

Barry Ritholtz

MAY 1, 2025

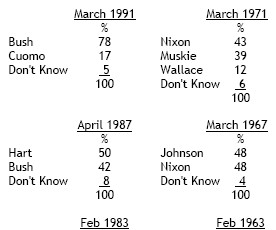

This is more than overconfidence, the DKE is how poorly we are at metacognition assessing our own abilities at a specific task Look at the history of performance and the small number of professional investors who outperform their benchmarks over 1, 5, 10, and 20 years. What are some examples of bad numbers?

Let's personalize your content