Driving seamless data integration for successful treasury management

Future CFO

OCTOBER 30, 2023

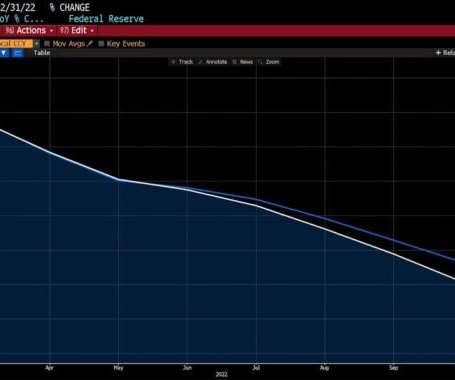

As more high-value treasury operations require cross-functional collaboration, data integration between systems becomes essential. Treasury teams can redirect their time and expertise toward strategic tasks, unburdened by the tedium of manual data entry.

Let's personalize your content