How Advisors Can Create An Annual Financial Planning Process

CFO News Room

NOVEMBER 21, 2022

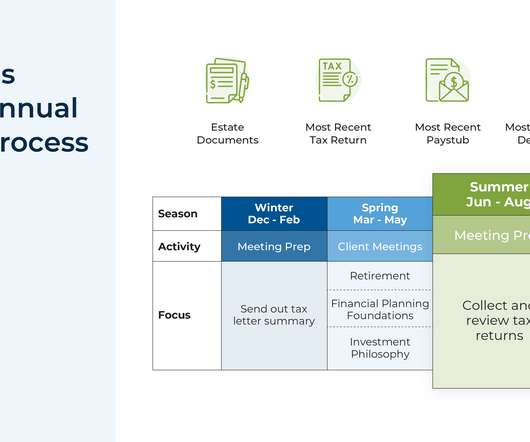

However, by creating a systematic annual process to monitor and update client plans based on seasons, not only can advisors save time and work more efficiently, but they can also communicate the value of ongoing financial planning services to prospects and clients more effectively. Author: Kyle Moore. Guest Contributor.

Let's personalize your content