Key features for FA&P software to choose the best one

Spreadym

APRIL 27, 2023

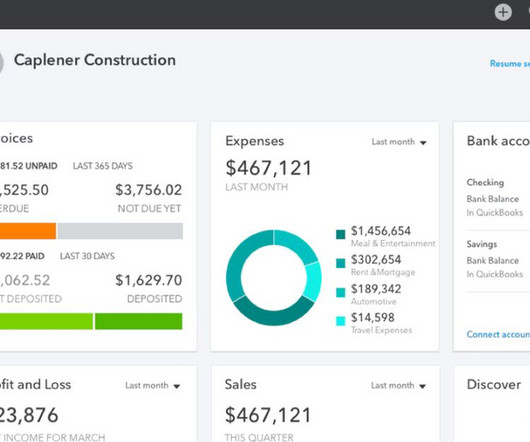

Financial analysis and planning (or FA&P) software is a type of business software that helps companies manage their finances and operational activity by analyzing financial data and providing tools to plan, forecast and make budgets for efficient business growth. Visit the link to learn more about it.

Let's personalize your content