Navigating Mergers and Acquisitions: A Strategic Guide for CFOs in South Africa

CFO Talks

SEPTEMBER 10, 2024

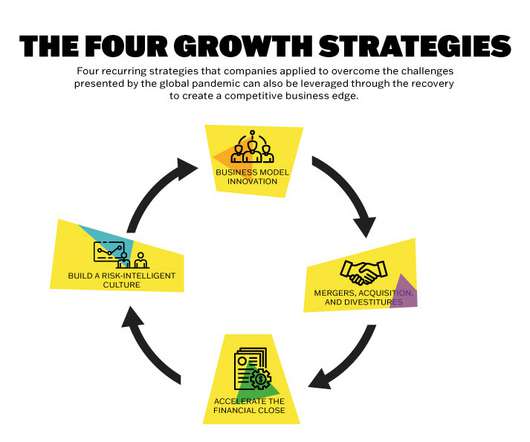

Navigating Mergers and Acquisitions: A Strategic Guide for CFOs in South Africa Mergers and acquisitions (M&A) are powerful tools for growth, diversification, and innovation in today’s competitive business landscape. However, they come with inherent risks and complexities.

Let's personalize your content