Financial Accounting Hierarchy - By JP Puchulu

Boston Startup CFO

APRIL 3, 2023

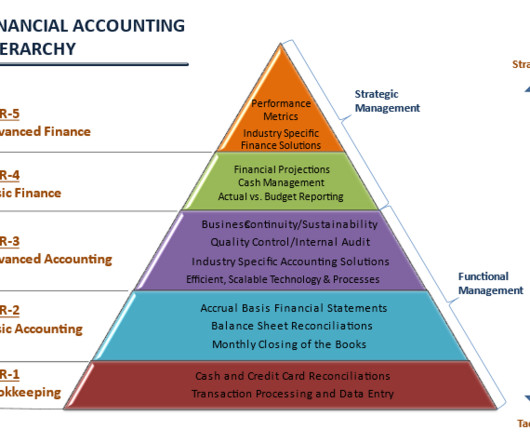

However, don't undervalue the significance of comprehending finance for your startup's survival. Tier 2: Basic Accounting In this tier, accountants close the books on a monthly basis and create basic financial statements to aid founders in assessing their startup's financial standing.

Let's personalize your content