From Jo’burg to Jakarta: The CFO’s Passport to Global Control

CFO Talks

AUGUST 6, 2025

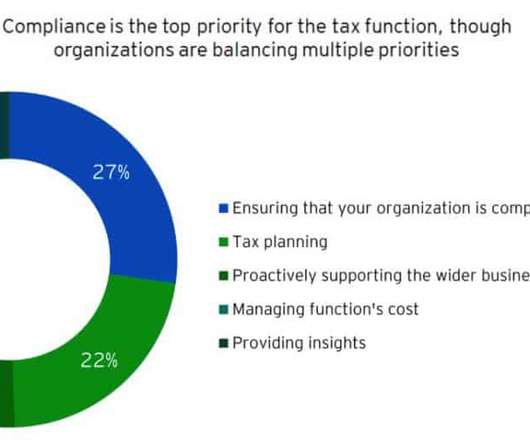

It’s about governance, compliance, control, cash flow, and risk, at scale. What to Consider Before Crossing the Border If your business is planning to expand internationally or already operates in multiple regions, here are critical areas that require your attention: 1. What to Look Out For Ignoring local tax advice.

Let's personalize your content