A Business Upended: Streaming disrupts the Entertainment Business!

Musings on Markets

SEPTEMBER 11, 2023

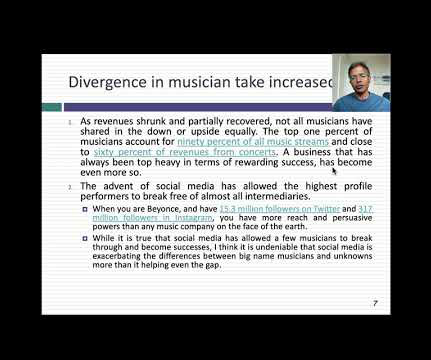

The recent troubles in entertainment, though, reflect a longer term disruption that has occurred in the business, with the rise of streaming as an alternative to the traditional platforms for movies and television shows. That said, the movie business remained concentrated, with the biggest players dominating each segment of the business.

Let's personalize your content