A Primer on Free Cash Flow

CFO News Room

JANUARY 8, 2023

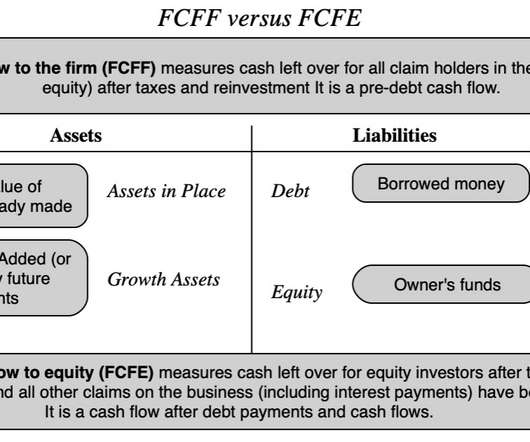

and which ones to include (cash acquisitions, foreign exchange gains or losses etc.). That can explain why a firm with moderate or even below-average profitability can use debt to fund large dividends and buybacks, and to the extent that the firm is borrowing too much, it can dig a hole for itself.

Let's personalize your content