Global trade to rebound modestly: Allianz

Future CFO

JANUARY 3, 2024

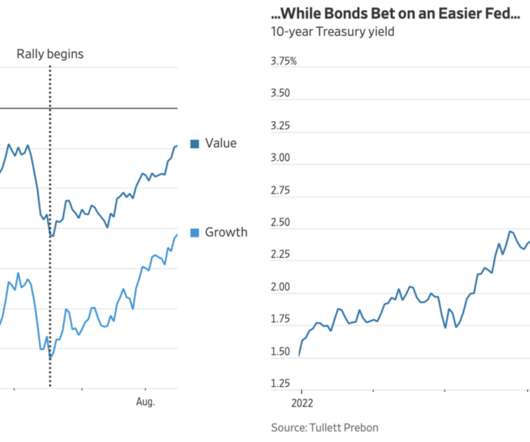

Global trade is set to rebound modestly after two consecutive years of below-average global GDP growth, said Allianz recently when releasing its Global Economic Outlook 2023-25. THe firm forecasts 2024 GDP growth at +1.4% Central banks are predicted to pivot earlier than expected by economic forecasters (i.e.

Let's personalize your content