10 Sunday Reads

Barry Ritholtz

APRIL 14, 2024

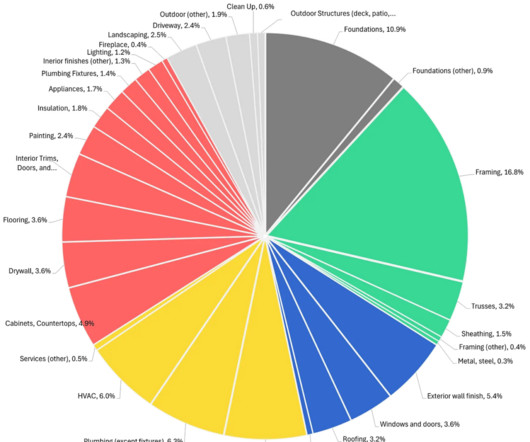

Wall Street Journal ) • As Kushner’s Investment Firm Steps Out, the Potential Conflicts Are Growing : Jared Kushner’s Affinity Partners has invested more than $1.2 It’s a common story across the pharmaceutical industry. Source: Construction Physics Sign up for our reads-only mailing list here. ~~~ Still on book leave.

Let's personalize your content