The Difference Makers: Key Person(s) Valuation

Musings on Markets

DECEMBER 10, 2023

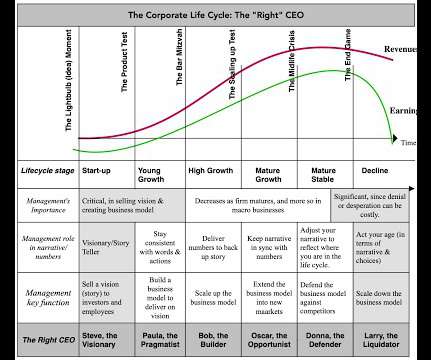

Of course, and with small businesses, especially those built around personal services (a doctor or plumber’s practice), it is part of the valuation process, where the key person is valued or at least priced and incorporated into valuation. Who is a key person?

Let's personalize your content