10 Friday AM Reads

Barry Ritholtz

APRIL 7, 2023

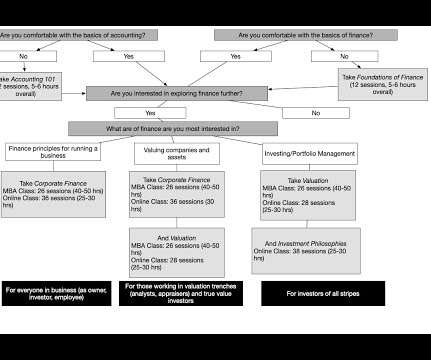

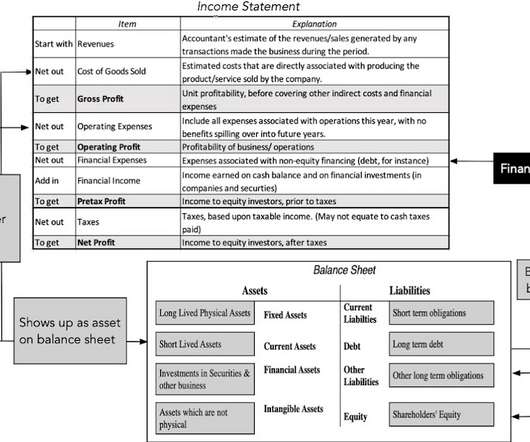

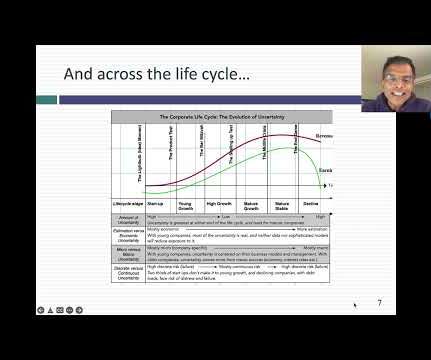

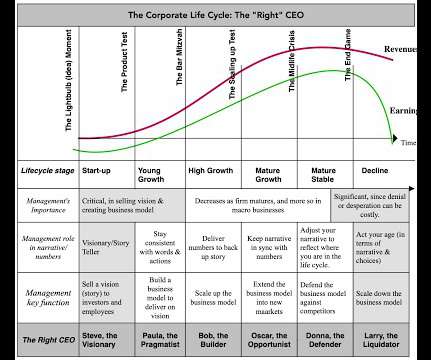

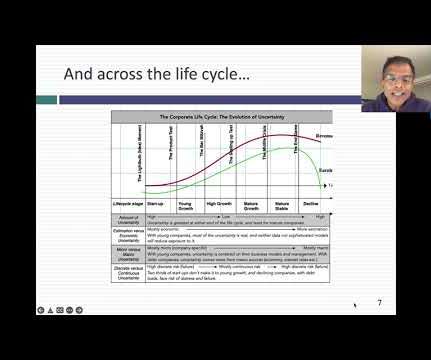

American Prospect ) see also Six Ways Existing Economic Models Are Killing the Economy : The alleged science doesn’t match up to the real world. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A.

Let's personalize your content