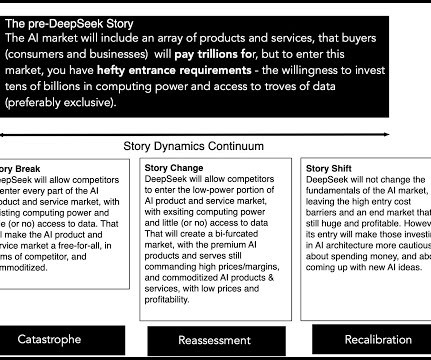

DeepSeek crashes the AI Party: Story Break, Change or Shift?

Musings on Markets

JANUARY 31, 2025

Nvidia market share: In my valuation, I assumed that Nvidia's lead in the AI chip business would give the company a head start, as the business grew, and to the extent that demand is sticky (i.e., The AI Story, after DeepSeek I teach valuation, and have done so for close to forty years.

Let's personalize your content