Data Update 3 for 2024: Interest Rates in 2023 - A Rule-breaking Year!

Musings on Markets

JANUARY 24, 2024

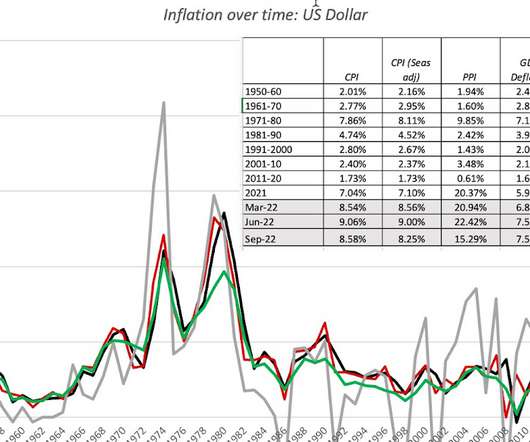

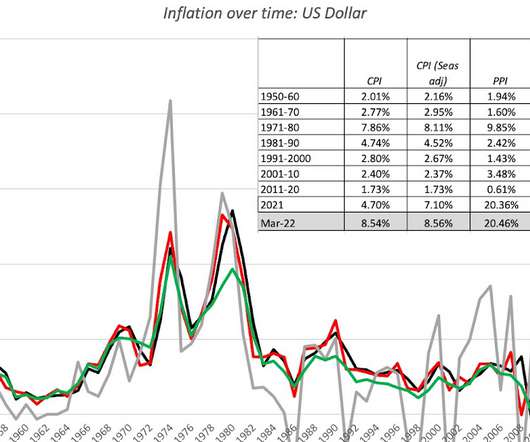

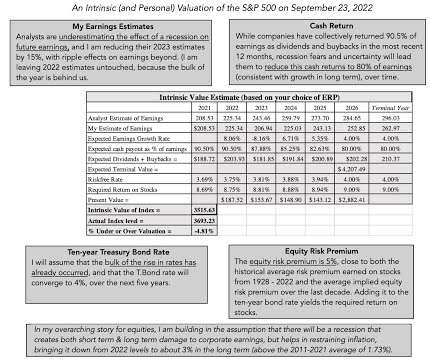

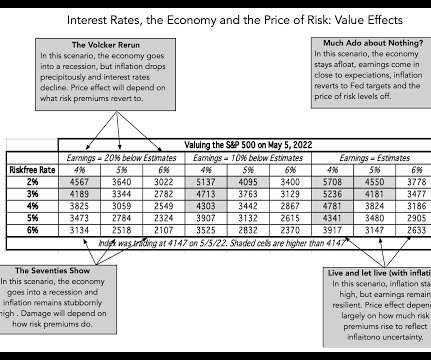

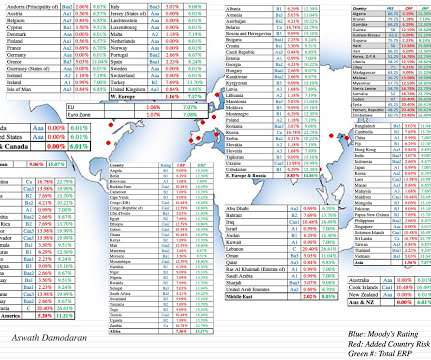

Government Bond/Bill Rates in 2023 I will start by looking at government bond rates across the world, with the emphasis on US treasuries, which suffered their worst year in history in 2022, down close to 20% for the year, as interest rates surged. The Fed Effect: Where's the beef? The Fed Effect: Where's the beef?

Let's personalize your content