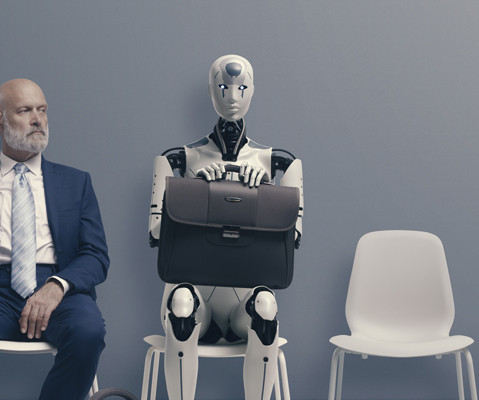

Ready to Make the Most out of Record-Setting Private Equity Growth?

E78 Partners

APRIL 13, 2023

Preqin , the leading trusted industry data provider, forecasts that global private capital assets under management (AUM) will reach a staggering $18.3 Transition of Leadership Leadership and governance : We provide C-level interim and project leadership with the experience and perspective your firm needs.

Let's personalize your content