Risk = Danger + Opportunity!

CFO News Room

JANUARY 20, 2023

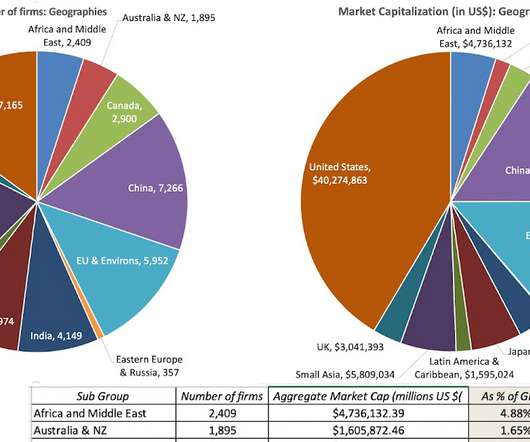

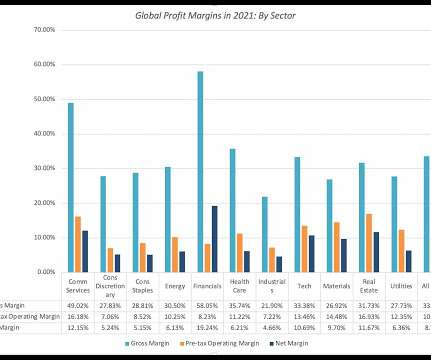

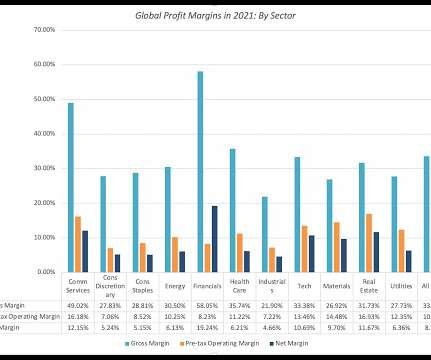

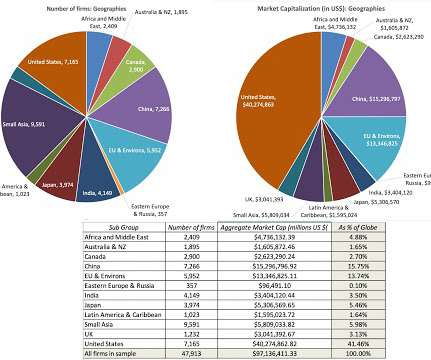

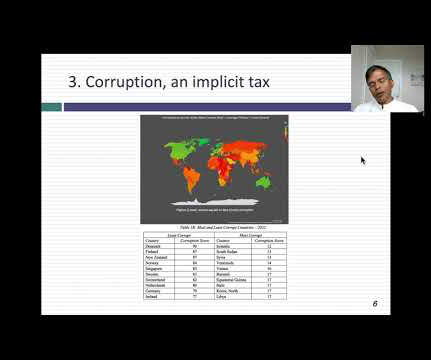

Risk and Hurdle Rates In investing and corporate finance, we have no choice but to come up with measures of risk, flawed though they might be, that can be converted into numbers that drive decisions. By the same token, Embraer and TCS are global firms that happen to be incorporated in Brazil and India, respectively.

Let's personalize your content