Gartner: CFOs likely to reduce sustainability spend before talent development, tech

CFO Dive

JULY 25, 2022

Economic pressures could lead CFOs to cut down on investments in sustainability despite a growing executive focus on ESG, Gartner finds.

CFO Dive

JULY 25, 2022

Economic pressures could lead CFOs to cut down on investments in sustainability despite a growing executive focus on ESG, Gartner finds.

Corporate Finance

JULY 25, 2022

Every July 1st is Bobby Bonilla Day! You may not be aware that the now retired slugger signed a contract with the New York Mets in 2000 that deferred his $5.9 million salary in exchange for about $1.2 million per year from 2011 through 2035 on July 1st. And while this is a great payday, Bobby Bo recently announced that he was auctioning off his copy of the famous contract.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JULY 25, 2022

Training managers to publicly acknowledge employees for who they are and what they do could save a 10,000-employee company up to $16.1 million in turnover costs annually.

Navigator SAP

JULY 25, 2022

In a recent article, we discussed how you can i mplement an enterprise resource planning (ERP) system in your company. Once your ERP solution is up and running, it's time to integrate it with the other tools and software that you already use.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

CFO Dive

JULY 25, 2022

Wrap Technologies expects demand for non-lethal law enforcement tools to grow as communities seek more hands-off and compassionate policing practices in the wake of the murder of George Floyd.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

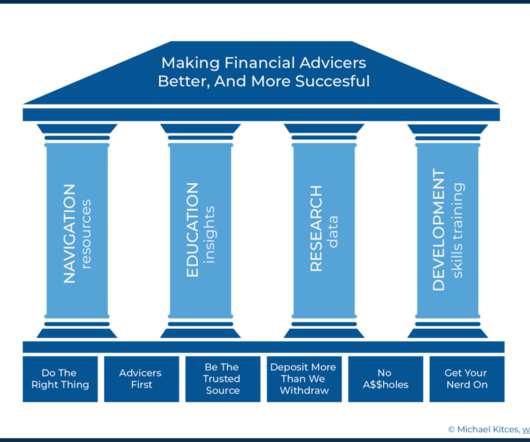

Nerd's Eye View

JULY 25, 2022

2022 was a year that began with high hopes as households were slowly re-emerging from pandemic shutdowns, markets were reaching new highs, and most advisory firms had growing momentum. Within just a few months, though, Omicron had led to another wave of at least partial shutdowns, inflation began to rear its ugly head in a way not seen in decades, and the market fell to its worst first-half start since 1970.

CSC Advisors

JULY 25, 2022

Asset-based lending is a $465 billion market. This type of lending is becoming more popular, as it can be a faster and easier way for businesses to get the money they need. Asset based lending is a great option for businesses that have a lot of assets, but may not have the best credit score. This type of lending is also a good option for businesses that need money quickly, as it can be a faster way to get funding than other types of loans.

Future CFO

JULY 25, 2022

When it comes to corporate investment, M&A and sustainability will be the first areas to face cuts in organisations feeling their margins triple squeezed by rising inflation, talent shortages and supply constraints, said Gartner recently when releasing results of a survey. The survey was done in June 2022 and collected responses from 128 CFOs and CEOs, according to the advisory firm.

Collectiv

JULY 25, 2022

JBT Automated Systems and Robotics is a leading provider of Automated Guided Vehicles (AGVs) for a wide range of industries, including automotive, food and beverage, healthcare and hospital, packaging, and consumer goods. Built to efficiently move industrial loads around factories and warehouses, AGVs use a combination of heavy-duty machinery and sensor-based guidance systems.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Financial Analyst Insider

JULY 25, 2022

Managing your finances is tricky, and some people like to utilise outsider support to get them on the straight and narrow. Small businesses might have. The post The Rise Of US Finance Merchants: What Are They? appeared first on Financial Analyst Insider.

Strategic Treasurer

JULY 25, 2022

Episode 211. Synthetic Identities and a CISO View: A Series on Cyber Security. A few years ago, most of our business was done in person, and your personal identity was showing up with your face and signature. As we move to a remote, digital work environment, creating Synthetic Identities is becoming easier and more common. In this podcast, Craig Jeffery of Strategic Treasurer talks with Jonathan Doskocil of TD Bank and Tyler Farrar of Exabeam on the importance of identity verification, education

Essentials of Corporate Finance

JULY 25, 2022

Every July 1st is Bobby Bonilla Day! You may not be aware that the now retired slugger signed a contract with the New York Mets in 2000 that deferred his $5.9 million salary in exchange for about $1.2 million per year from 2011 through 2035 on July 1st. And while this is a great payday, Bobby Bo recently announced that he was auctioning off his copy of the famous contract.

Corporate Finance Lab

JULY 25, 2022

Literatuur is voor juristen een schier levensnoodzakelijke bron van lering en vorming’ Ter inspiratie voor onze zomerlectuur vroeg Corporate Finance Lab enkele BJ’s (bekende juristen) en vrienden van het Lab: (1) Welke boeken hebben u als jurist het meest gevormd ? en (2) Welke boeken neemt u straks mee op vakantie of beveelt u aan? Vandaag: Herman Cousy, emeritus gewoon hoogleraar handels- en verzekeringsrecht aan de KU Leuven en lid van de Koninklijke Vlaamse Academie van België.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Let's personalize your content