3 ways CFOs can utilize ERP as recession hedge

CFO Dive

OCTOBER 19, 2022

Strong enterprise resource planning (ERP) systems can help businesses prepare to survive an impending and potentially inevitable recession.

CFO Dive

OCTOBER 19, 2022

Strong enterprise resource planning (ERP) systems can help businesses prepare to survive an impending and potentially inevitable recession.

Navigator SAP

OCTOBER 14, 2022

It’s an uphill task for Contract Development and Manufacturer Organizations (CDMOs) to ensure product quality at the rapid pace demanded by customers, especially when they must deal with safety, control, and regulatory regimes in fields such as pharmaceuticals, biotech, and other areas of the life sciences.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Barry Ritholtz

OCTOBER 26, 2022

Today’s edition of “ Nobody Knows Anything ” is about a once-dominant mobile phone maker. Exactly 15 years ago, Forbes’s new cover story lauded Olli-Pekka Kallasvuo, Nokia’s CEO. The headline trumpeted: “Nokia, one billion customers – can anyone catch the cell phone king?” It was posted online October 26, 2007 — 15 years ago today.

The Reformed Broker

OCTOBER 3, 2022

I’m going to tell you a quick story in the order in which it happened. You were there. You will be familiar with the sequence of these events. But you may not have reached the shocking conclusion that I have. At least not yet. Wait for it… Our story begins in 2019… It was the best of times, it was the best of times. The tail end of a decade of uninterrupted asset price appreciation for the top decile of.

Advertisement

Navigating travel expenses can be challenging, but our workbook offers a clear path forward. Learn to craft a travel policy that fits your budget and makes travel management simple. This self-guided workbook offers: Practical advice on choosing airlines, setting booking time frames, and managing travel costs effectively. Insights into selecting the right class of service for each employee, ensuring everyone travels comfortably and within policy.

CFA Institute

OCTOBER 25, 2022

Not all traditional investment management techniques are applicable to digital assets, but sector breakdowns, DCF models, and risk factor modeling are solid starting points.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO Dive

OCTOBER 11, 2022

Digital transformation is another responsibility that has shifted over to CFOs, with 61% now in charge of technology budgeting, spend and approval, a recent study found.

Navigator SAP

OCTOBER 21, 2022

In the past three years, the biotech sector has seen a boom in venture capital (VC) funding. Research from McKinsey has shown that VCs invested in 2,200 biotech start-ups worldwide in 2016, and that increased to 3,100 in 2021. These biotech companies raised over $34 billion globally in 2021.

Barry Ritholtz

OCTOBER 18, 2022

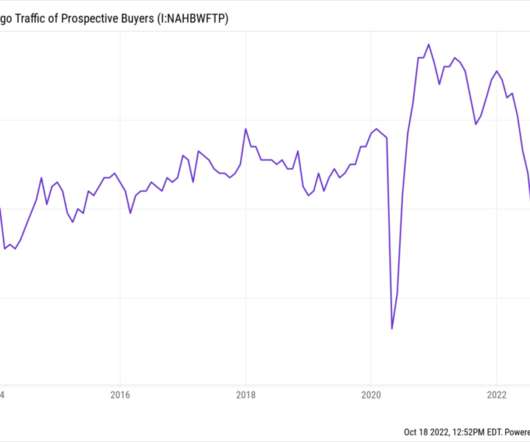

At the beginning of each quarter, I prepare a short but in-depth conference call for RWM clients. The team & I put together the most revealing and informative slides. In that half hour, I blow through ~40 slides that capture and explain what is going on. About a quarter of the October 2022 slides were focused on real estate. This is atypical. The reason we emphasized real estate this Q is that housing is very often where we see FOMC policy having its most immediate effect.

The Reformed Broker

OCTOBER 3, 2022

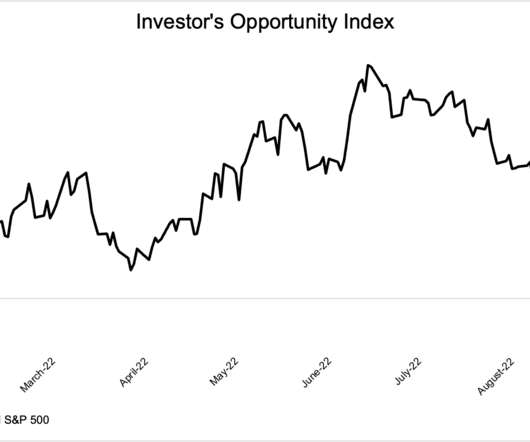

Every bear market has these two things in common: They end Expected returns go up The first thing is self-explanatory. The second thing should be obvious but from my talks with thousands of investors over the years, I have found that it is most certainly not intuitive to most people. When I tell you that expected returns are rising as stock prices fall, this is an overly simplistic way of saying that investors only get.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

CFO Leadership

OCTOBER 10, 2022

Many businesses are looking more toward the future, eager to move beyond years of disruption and uncertainty due to the COVID-19 pandemic. The upside of that experience is that it gives chief financial officers (CFOs) and other senior executives a rare opportunity to build on lessons learned and successes earned to create a more dynamic, flexible, resilient and highly skilled workforce for the future.

CFO Simplified

OCTOBER 30, 2022

If you’re in a business that’s experiencing exponential growth, one of the problems that you’re facing even now is staffing. How are you planning on staffing for this as you move forward and continue to experience high levels of growth? Consider: That strategic plan for how you’re going to conduct staffing is critical to your success.

CFO Dive

OCTOBER 25, 2022

Cronos, a Canadian producer of marijuana-based products, settled with regulators over charges of faulty accounting and lax controls.

Navigator SAP

OCTOBER 1, 2022

The COVID-19 pandemic unsettled the supply chain, and the Ukraine-Russia war, ongoing cyberattacks, and trade disputes have only continued the trend. This has put pressure on manufacturing, with particular challenges for companies that source components and products from disparate geographies. Life sciences , which involve complex supply chains and various types of subcontractors, have been hit particularly hard.

Advertiser: Paycor

HR doesn’t exist in a vacuum. This work impacts everyone: from the C-Suite to your newest hire. It also drives results. Learn how to make it all happen in Paycor’s latest guide.

Barry Ritholtz

OCTOBER 16, 2022

This is pretty mind-blowing: a podcast that is entirely generated by artificial intelligence where Joe Rogan interviews Steve Jobs. One of the most important women in Apple’s history never worked for Apple Margot Comstock took her winnings from a TV game show and bought a computer. It led to a magazine, which turned into a major hub for the nascent community of developers and fans of one of the most important computers in history.

The Reformed Broker

OCTOBER 8, 2022

Thanks for checking out piece from last Sunday “You weren’t supposed to see that” – it went crazy viral all over the place. I can’t believe how much feedback came in. Mostly in agreement with my conclusion but not all of it, there were some reasonable counterarguments too. And if you haven’t subscribed yet, don’t wait.

CFO Talks

OCTOBER 26, 2022

1X. ‘ Passionate about the public sector ‘ Welcome to the CFO Club Africa podcast, where we interview leading CFOs from Africa and beyond. CFO Club Africa is a division of the Chartered Institute of Business Accountants, the professional body for business accountants, financial managers and chief financial officers. Go to www.cfoclub.co.za and join our community of accounting and finance executives.

Centage

OCTOBER 24, 2022

It’s no secret that another recession may be on the horizon. Not only is the world still grappling with the effects of the ongoing COVID pandemic, but high interest rates and elevated inflation have many concerned that an economic downturn is coming. In fact a recent model run by Ned Davis Research revealed that the probability of a global recession is 98.1 percent.

Speaker: James Kahler, COO of Full Course

Ever wondered where to splurge and where to safely conserve when it comes to operating and growing your restaurant? 🤔 Join James Kahler, COO of Full Course and industry visionary, in this new webinar where he'll talk all about best practices to invest in your restaurant's success! Whether you're a new business or an established restaurant, a seasoned pro or a rookie, you'll learn the keys to sustainable success in this competitive industry.

CFO Dive

OCTOBER 7, 2022

Most companies have, to some degree, embraced cloud computing but do not always clearly identify return on investment.

Navigator SAP

OCTOBER 20, 2022

What is UBIX? UBIX is an Advanced Analytics and AI Platform designed for the business user. The general-purpose platform can address any number of use cases from the front office to the back office, such as customer analytics, financial analytics, HR analytics, demand forecasting, procurement, and more.

Barry Ritholtz

OCTOBER 14, 2022

There’s nothing like confusing market action to send people into narrative creation overdrive. Yesterday’s 2% collapse on hotter-than-expected CPI data, followed by ~5% recovery to finish the day up more than 2% is a perfect example of random market action begetting endless explanations. What was the takeaway from CPI? Check out the BAML chart above: Core goods are coming down ( that’s good!

The Reformed Broker

OCTOBER 15, 2022

Hey guys, didn’t get a chance to do any writing this week but we did two really good shows on the YouTube / podcast front I wanted to make sure you don’t miss… And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

Speaker: Jamie Eagan

As organizations strive for agility and efficiency, it's imperative for finance leaders to embrace innovative technologies and redefine traditional processes. Join us as we explore the pivotal role of digitalization and automation in reshaping what is commonly referred to as the “last mile of reporting”. We’ll deep-dive into why digitalization is no longer a choice, but a necessity for finance departments to stay competitive in a fast-paced environment touching on: 2024 trends for the Office of

CFO Simplified

OCTOBER 24, 2022

As a business owner, you must understand the importance of reconciling your accounts—and no, not just your checking accounts! Do you know what accounts you need to be reconciling regularly? Read on to find out from Larry Chester , President of CFO Simplified. Do You Know What Business Accounts You Must Reconcile? Larry Chester speaks with business owners all the time about their month-end close.

Centage

OCTOBER 17, 2022

Individuals and businesses alike have endured extreme stress in recent years, and there’s no sign of the situation improving any time soon. Along with the continuing impact of the COVID pandemic, companies are currently dealing with the effects of Russia’s war on Ukraine, sky-high inflation, supply chain shortages, and rising interest rates, among other challenges.

CFO Dive

OCTOBER 12, 2022

The FASB’s tentative decision Wednesday is an important step toward providing an answer to the crypto valuation question companies and other stakeholders have been clamoring for.

Navigator SAP

OCTOBER 7, 2022

Anyone who runs a business knows how important supply chain management is. Ensuring the smooth flow of the resources you need to keep your business running is crucial, especially in a modern world where buying patterns, changing technology, and global events can affect the price and availability of those resources in unexpected ways. In fact, supply chain management is so important that business owners and their employees tend to spend an inordinate amount of time on it.

Advertisement

In this white paper, we explore the factors to consider in deciding whether the time is right for your Company to consider a new ERP or accounting software, the total cost of ownership and plans necessary to make the potential leap to these systems.

Let's personalize your content