Weekend Reading For Financial Planners (June 1-2)

Nerd's Eye View

MAY 31, 2024

Going beyond FPA’s existing PlannerSearch tool, the narrowed-down list is meant to help consumers identify a focused subset of the most reputable planners.

Nerd's Eye View

MAY 31, 2024

Going beyond FPA’s existing PlannerSearch tool, the narrowed-down list is meant to help consumers identify a focused subset of the most reputable planners.

CFO News Room

NOVEMBER 30, 2022

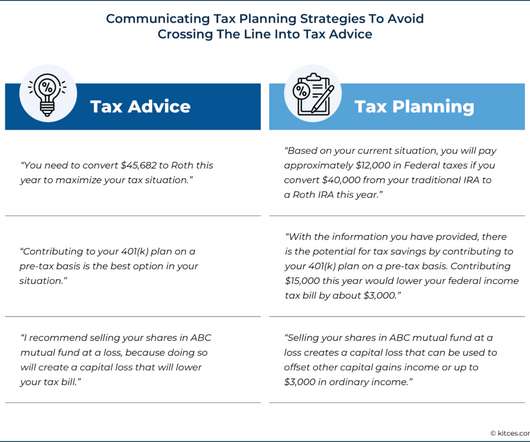

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Spreadym

NOVEMBER 3, 2023

Financial planning typically includes the following key components: Setting Financial Goals: Identify and prioritize your short-term and long-term financial objectives, such as saving for retirement, buying a home, paying off debt, or funding your children's education. ROIC helps in evaluating the overall return on capital investments.

The CFO College

APRIL 8, 2021

Investing time and money every month into expanding your “VIP” could increase your revenue, especially if you commit to doing something to work on these three areas for one hour a day. Another key aspect of becoming a Valuable Expert is enhancing your education.

CFO News Room

NOVEMBER 28, 2022

Traditionally, investment planning has been at the forefront of how financial advisors add value for their clients. But, with the rise of index funds and the commoditization of investment advice, generating sufficient investment ‘alpha’ to justify a fee has become more challenging for advisors.

CFO News Room

DECEMBER 17, 2022

In order to obtain the CFP certification, an individual must complete what are known as the “Four E’s”: Education , Examination , Experience , and Ethics. And current holders of the CFP marks have a Continuing Education (CE) requirement of at least 30 hours every two years. Melanie Waddell | ThinkAdvisor).

CFO News Room

FEBRUARY 2, 2022

And that takes you down a road of increasingly complex or sophisticated investment vehicles, the move towards alternatives, the move towards private equity and hedge funds and a lot of different things that get done with the portfolios of high-net-worth clients. Estate planning is commonly a big point of discussion, as well.

Let's personalize your content