Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

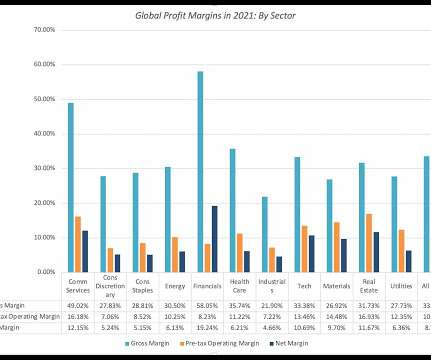

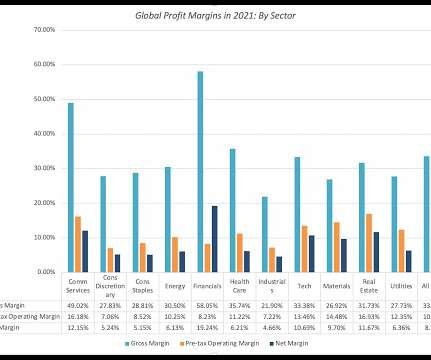

Income from financial holdings (including cash balances, investments in financial securities and minority holdings in other businesses) are added back, and interest expenses on debt are subtracted out to get to taxable income. Returns on Invested Capital (or Equity).

Let's personalize your content