Musings on Markets: Data Update 1 for 2023: Setting the table!

CFO News Room

JANUARY 7, 2023

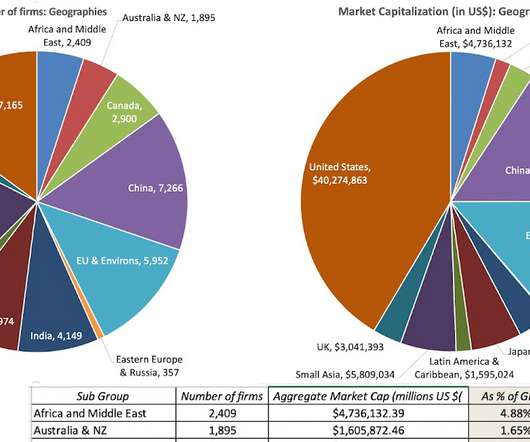

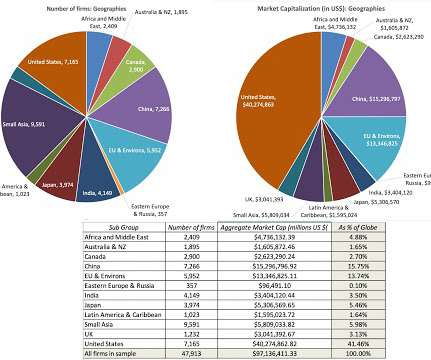

Data: Trickle to a Flood! It is perhaps a reflection of my age that I remember when getting data to do corporate financial analysis or valuation was a chore. By the same token, it is impossible to use a pricing metric (PE or EV to EBITDA), without a sense of the cross sectional distribution of that metric at the time.

Let's personalize your content