Types of Financial Models for Greater Business Development

Spreadym

JULY 14, 2023

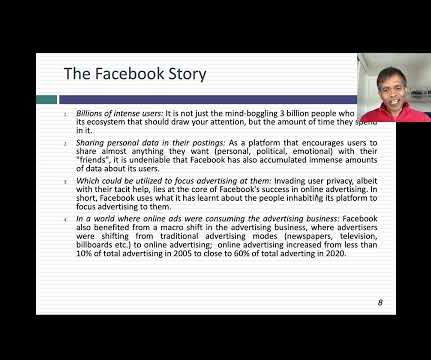

Financial models are mathematical representations or frameworks used to analyze the financial performance and make predictions about the future financial outcomes of a business, project, or investment. Financial models can take different forms depending on their purpose and complexity.

Let's personalize your content