FP&A’s Scope: What Is In And What Is Out?

Fpanda Club

JANUARY 23, 2025

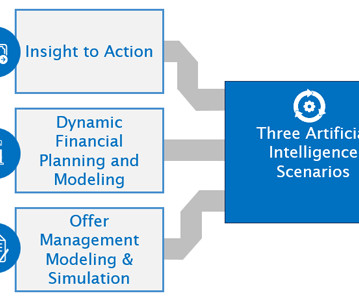

FP&As role is to connect those insights to financial models and forecasts. FP&As expertise in financial modeling and scenario analysis makes it the ideal function to assess these cases. By projecting costs, revenues, and risks, FP&A can provide a clear picture of the potential financial outcomes.

Let's personalize your content