A Fresh Look at Ongoing ESG and Carbon Accounting Developments

Bramasol

JULY 22, 2023

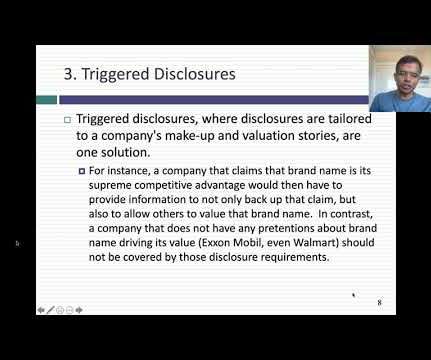

Global ESG Regulatory Requirements One of the major ESG compliance developments to watch is the US Securities and Exchange Commission (SEC) proposed regulation on Climate-Related Disclosures and ESG Investing. IFRS S1 requires companies to communicate the sustainability risks and opportunities they face over the short, medium, and long term.

Let's personalize your content