Designing Effective Financial Information Systems: A Guide for South African CFOs

CFO Talks

SEPTEMBER 5, 2024

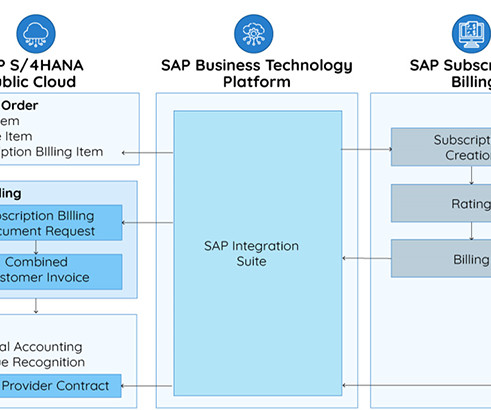

Ensuring Data Integration In today’s interconnected world, your FIS must seamlessly integrate with other business systems, such as Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and Human Resources (HR) systems. Planning for Scalability Finally, it’s crucial to design your FIS with the future in mind.

Let's personalize your content