When Does Your Nonprofit Need an Audit?

The Charity CFO

DECEMBER 30, 2021

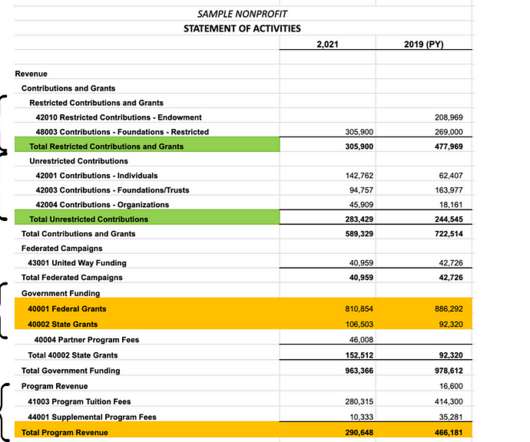

It assures outside observers that “the organization’s financial records meet generally accepted accounting principles.” And that inspires trust and confidence among potential funders, banks, and other potential partners. Many banks will ask for audited financials as a prerequisite for lending you money. .

Let's personalize your content